san francisco county sales tax rate

Payments at the cashier window accepted until 5 pm. San Francisco California sales tax rate details The minimum combined 2021 sales tax rate for San Francisco California is 863.

Understanding California S Sales Tax

You can find more tax rates and allowances for San Francisco County and California in.

. If you travel to San Francisco County youll pay a sales tax rate of 85 percent since the county rate is 125 percent which is 75 percent lower than Alameda County. The average sales tax rate in California is 8551. Finding and staying in housing.

Find jobs fellowships and internships with the City. The California sales tax rate is currently 6. 3 rows The current total local sales tax rate in San Francisco County CA is 8625.

The Office of the Treasurer Tax Collector is open from 8 am. In light of the COVID-19 public health crisis and shelter-in-place orders in effect in San Francisco the sale scheduled for May 1 2020 through May 4 2020 has been cancelled. SAN FRANCISCO COUNTY 8625 SAN JOAQUIN COUNTY 775 City of Lathrop 875 City of Lodi 825 City of Manteca 825 City of Stockton 900 City of Tracy 825 SAN LUIS OBISPO COUNTY 725 City of Arroyo Grande 775 City of Atascadero 875 City of Grover Beach 875 City of Morro Bay 875 City of Paso Robles 875 City of Pismo Beach 775.

The minimum combined sales tax rate for San Francisco California is 85. Tax rate for entire value or consideration is. 250 for each 500 or portion thereof.

Presidio of Monterey Monterey 9250. 1000000 or more but less than 5000000. Sales Tax and Use Tax Rate of Zip Code 94110 is located in San francisco City San Francisco County California State.

California has a 6 sales tax and San Francisco County collects an additional 025 so the minimum sales tax rate in San Francisco County is 625 not including any city or special district taxes. The San Francisco sales tax rate is 0. Get personal records pay taxes or fines work or volunteer with the City.

Driving parking buses Muni and paratransit. Tell us about issues. San Francisco Assessors Office FAQ Sheets Real Estate Transfer Taxes in San Francisco Transfer tax is a transaction fee imposed on the transfer of land or real property from one person or entity to another.

The South San Francisco California sales tax is 750 the same as the California state sales tax. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. 6 rows The San Francisco County California sales tax is 850 consisting of 600 California state.

The County sales tax rate is 025. The Sales tax rates may. 340 for each 500 or portion thereof.

2 State Sales tax is 725. The 2018 United States Supreme Court decision in South Dakota v. Estimated Combined Tax Rate 850 Estimated County Tax Rate 025 Estimated City Tax Rate 000 Estimated.

The San Francisco County sales tax rate is. More than 250000 but less than 1000000. 1000000 or more but less than 5000000.

Presidio San Francisco 8625. More than 100 but less than or equal to 250000. The December 2020 total local sales tax rate was 9250.

Monday through Friday in room 140. Look up 2021 sales tax rates for San Francisco Colorado and surrounding areas. San Francisco City Hall is open to the public.

While many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be collected. San Francisco CA Sales Tax Rate The current total local sales tax rate in San Francisco. 94110 zip code sales tax and use tax rate San francisco San Francisco County California.

South San Francisco CA Sales Tax Rate. Personal safety and preparedness. The California sales tax rate is currently 6.

The 8625 sales tax rate in San Francisco consists of 6 California state sales tax. The transfer tax rate is variable depending on the purchase price OR the fair market value as shown in the chart below. The South San Francisco Sales Tax is collected by the merchant on all qualifying sales made within South San Francisco.

This is the total of state county and city sales tax rates. 6 rows The San Francisco County Sales Tax is 025. Auction Site bid4assets Timeshare Parcels.

The California state sales tax rate is currently. San Francisco County in California has a tax rate of 85 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in San Francisco County totaling 1. A county-wide sales tax rate of 025.

A base sales and use tax rate of 725 percent is applied. Resources and programs helpful to immigrants. This is the total of state county and city sales tax rates.

Method to calculate San Francisco County sales tax in 2021. Depending on the zipcode the sales tax rate of san francisco may vary. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375.

Tax rates are provided by Avalara and updated monthly. Walk-ins for assistance accepted until 4 pm. 2019 Public Auction.

Auction Site bid4assets Parcels Other Than Timeshares.

Sales Gas Taxes Increasing In The Bay Area And California

States With Highest And Lowest Sales Tax Rates

California Sales Tax Small Business Guide Truic

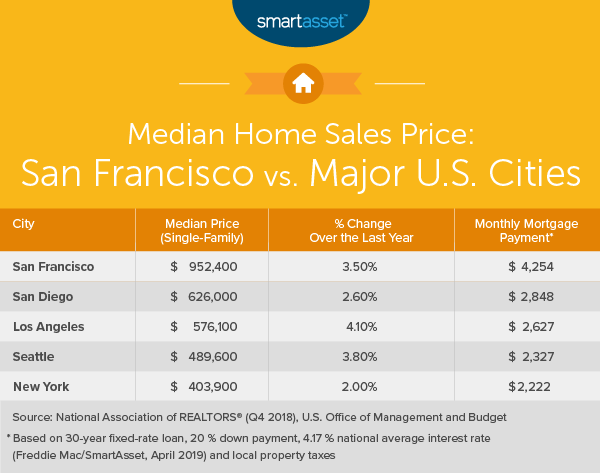

What Is The True Cost Of Living In San Francisco Smartasset

Understanding California S Sales Tax

San Francisco Prop W Transfer Tax Spur

Why Households Need 300 000 To Live A Middle Class Lifestyle

Why Households Need 300 000 To Live A Middle Class Lifestyle

California Sales Tax Rates By City County 2022

California Sales Tax Small Business Guide Truic

California City County Sales Use Tax Rates

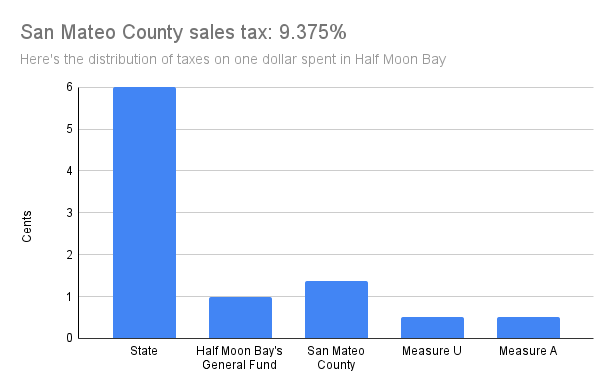

County Begins Collecting Higher Sales Tax Local News Stories Hmbreview Com

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Sales Tax By State Is Saas Taxable Taxjar

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Sales Tax Collections City Performance Scorecards

Sales Tax Rates Rise Up To 10 75 In Alameda County Highest In California Cbs San Francisco