how much does illinois tax on paychecks

Published January 21 2022. For a single employee paid weekly with taxable income of 500 the federal income tax in 2019 is 1870 plus 12 percent of the amount over 260.

Paycheck Calculator Take Home Pay Calculator

How Your Illinois Paycheck Works.

. This article is part of a larger series on How to Do Payroll. Employer payroll taxes include 765 FICA taxes a 54 state unemployment tax and a 08 federal unemployment tax. The employer cost of payroll tax is 124.

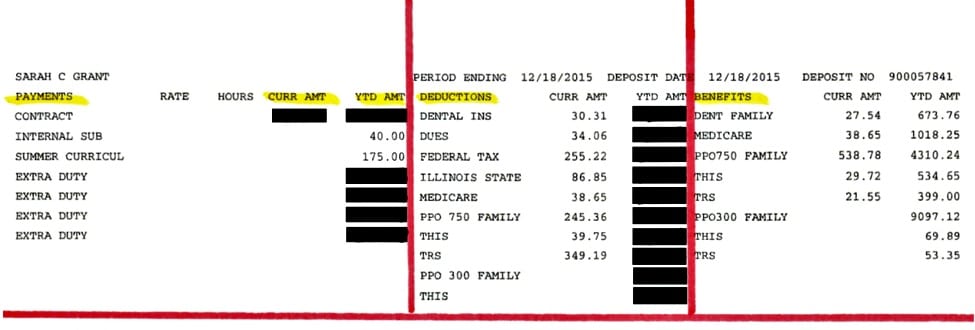

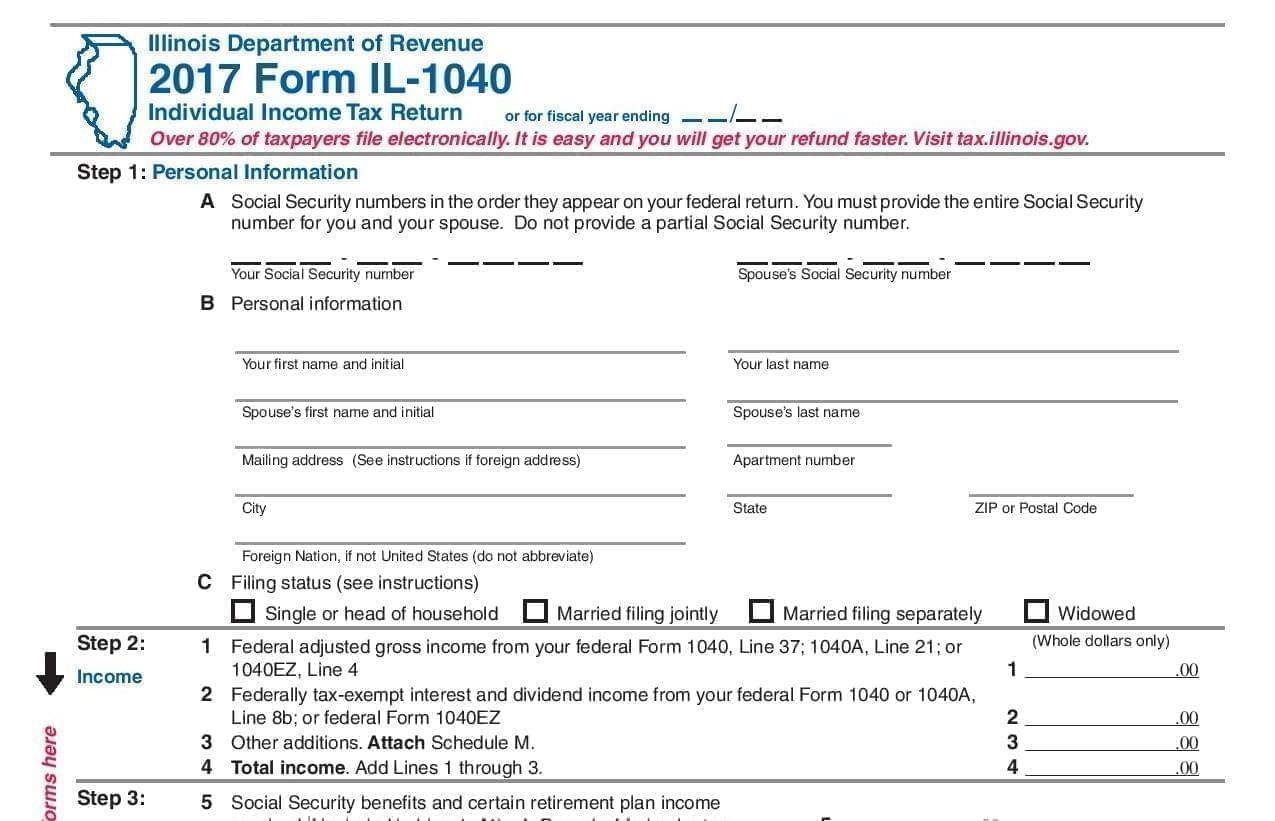

How much taxes does illinois take out of paycheck Sunday February 27 2022 Edit Each pay period 62 of your paycheck goes to your share of Social Security taxes and 145 goes to. The wage base is 12960 for 2021 and rates range from 0725 to 7625. As of 2018 the state income tax rate for Illinois is 495 percent of income after deducting for allowances the employee claims on IL-W-4.

Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state. If youre a new employer your rate is 353. Under federal law Paycheck Protection Program PPP loan forgiveness is not considered taxable income and the business expenses covered by the PPP loan proceeds are deductible business expenses.

The Illinois bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Unemployment Insurance UI supplies funding for the Illinois Department of Employment Security IDES which pays benefits to the unemployed. Under this system someone earning 10000 is taxed at 10 paying a total of 1000.

Different rates apply to tipped employees and employees under 18 years of age. The 10 rate applies to income from 1 to 10000 the 20 rate applies to income from 10001 to 20000 and the 30 rate applies to all income above 20000. Illinois income tax rate.

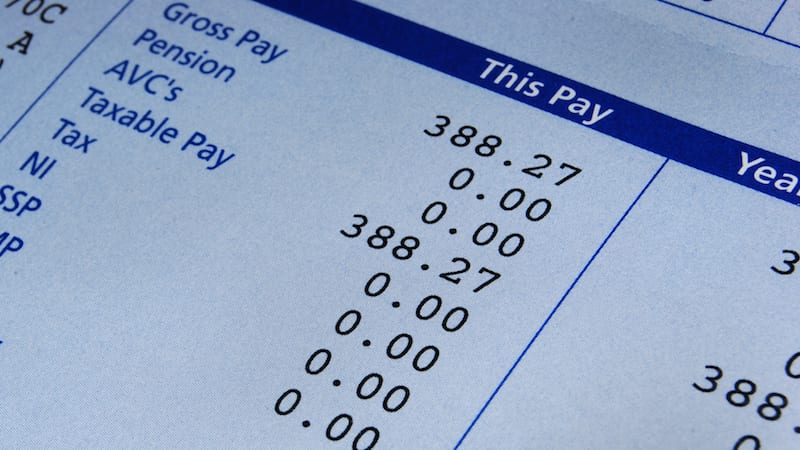

For example an employee with gross wages of 1500 biweekly and a 500 Section 125 deduction has 1000 in gross taxable wages 1500 500. Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return. Switch to Illinois hourly calculator.

Therefore the same treatment flows through to the Illinois return as the starting point for computing Illinois. What percent of taxes will be taken out of my paycheck. Your total tax would be.

Automatic deductions and filings direct deposits W-2s and 1099s. Additional Medicare Tax. Personal income tax in Illinois is a flat 495 for 20221.

Using Table 4-2 calculate the FUTA taxes for a new employer in the state of Nevada. The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State Income Tax Rates and Thresholds in 2022. The final 25000 of your income would be taxed at 30 or 7500.

The Waiver Request must be completed and submitted back to the Department. Someone earning 5000 pays 500 and so on. If youre married filing jointly youll see the 09 percent taken out of your paycheck if you earn 250000 or more.

Assuming a FICA tax rate of 765 percent a FUTA tax rate of 06 percent and a SUTA tax rate of 54 percent prepare the adjusting entry to. Census Bureau Number of cities that have local income taxes. How much taxes does illinois take out of paycheck Sunday February 27 2022 Edit Each pay period 62 of your paycheck goes to your share of Social Security taxes and 145 goes to.

How much taxes does illinois take out of paycheck Tuesday May 31 2022 Edit. The amount withheld per paycheck is 4150 divided by 26 paychecks or 15962. As of January 1 20221 the minimum wage in Illinois is 12100hour.

As of 2018 the state income tax rate for Illinois is 495 percent of income after deducting for allowances the employee claims on IL-W-4. The first step to calculating payroll in Illinois is applying the state tax rate to each employees earnings. Employees who desire to update their direct deposit via Employee Self Service must be on an Illinois State Network or using a VPN which can be obtained via the IT Helpdesk at 309438-4357.

Newly registered businesses must register with IDES within 30 days of starting up. At the time of publication the employee portion of the Social Security tax is assessed at 62 percent of gross wages while the Medicare tax is assessed at 145 percent. Details of the personal income tax rates used in the 2022 Illinois State Calculator are published below the.

The 500 gross figure is used here because personal exemptions do not exist for the tax year 2019. Both employers and employees are responsible for payroll taxes. Illinois Paycheck Quick Facts.

Enroll in direct deposit so your funds will be in your account on payday. If you are unable to file electronically you may request Form IL-900-EW Waiver Request through our Taxpayer Assistance Division at 1 800 732-8866 or 1 217 782-3336. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an individual paid.

Currently Illinois tax law has no addition modification to change this. Keep in mind that some pre-tax deductions eg Section 125 plans can lower the gross taxable wages and impact how much you contribute per employee paycheck. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks.

Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck calculator. This Illinois hourly paycheck calculator is perfect for those who are paid on an hourly basis. You may pay up to 050 less an hour for your new hires in their first 90 days of employment.

The next 30000 would be taxed at 20 or 6000. In that case your paycheck whether. How much tax is taken out of a 500 check.

In this scenario even though youre in the 30 bracket you would actually pay only about 207 of your income in taxes. There is an Additional Medicare Tax of 09 percent withheld from employees paychecks if they earn more than 200000 annually regardless of their income tax filing status or wages earned at another job. What is the tax on 2000.

The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State Income Tax Rates and Thresholds in 2022. Illinois Paycheck Calculator Updated For 2022. This works out to be 4750.

2000 6000 7500 15500. If you have not enrolled in direct deposit you can enroll through MyIllinoisState. This applies to workers over the age of 18.

How much is payroll tax in Illinois. When you were a teenager you may have had a part-time job that paid you under the table. Median household income in Illinois.

Sales Tax Is Called A Regressive Tax Because People Who Make Less Money End Up Spending A Larger Portion Of Their Pay Infographic Math Review Finance Investing.

Illinois Paycheck Calculator Smartasset

Illinois Paycheck Calculator Smartasset

Paycheck Calculator Take Home Pay Calculator

Understanding Your Teacher Paycheck We Are Teachers

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

Why Illinois Is In Trouble 109 881 Public Employees With 100 000 Paychecks Cost Taxpayers 14b

Mid 2017 State Income Tax Rate Hike Throws Off Taxpayers Illinois Public Media News Illinois Public Media

Why Illinois Is In Trouble 109 881 Public Employees With 100 000 Paychecks Cost Taxpayers 14b

Taxes 5 1 Taxes And Your Paycheck Payroll Taxes Based On Earnings Paid To Government By You And Employer Income Taxes You Pay On Income You Receive Ppt Download

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Understanding Your Teacher Paycheck We Are Teachers

Understanding Your Teacher Paycheck We Are Teachers

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Here S How Much Money You Take Home From A 75 000 Salary

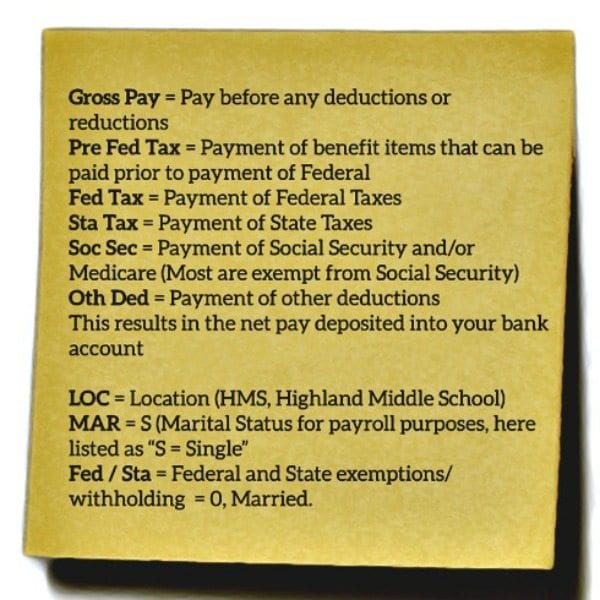

Understanding Your Pay Statement Office Of Human Resources

Final Paycheck Laws By State Findlaw

2022 Federal State Payroll Tax Rates For Employers