oklahoma sales tax car purchase

Some states charge annual excise fees for vehicles or a fee whenever you renew your registration. As noted above.

Oklahoma Sales Tax Small Business Guide Truic

The type of license plates requested.

. Standard vehicle excise tax is assessed as follows. The sales tax for new cars is 325 and for used cars the tax is 2000 for the first 150000. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way.

Vehicle buyers would still have to pay the excise tax under the new law so the combined taxes on vehicle purchases would total 45 percent which is the same amount as the sales tax. So if you used a 8 general sales tax rate for your state this would have to be the same sales tax rate for your vehicle purchase. Oklahoma has a 45 statewide sales tax rate but also has 470 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4241 on top of the state tax.

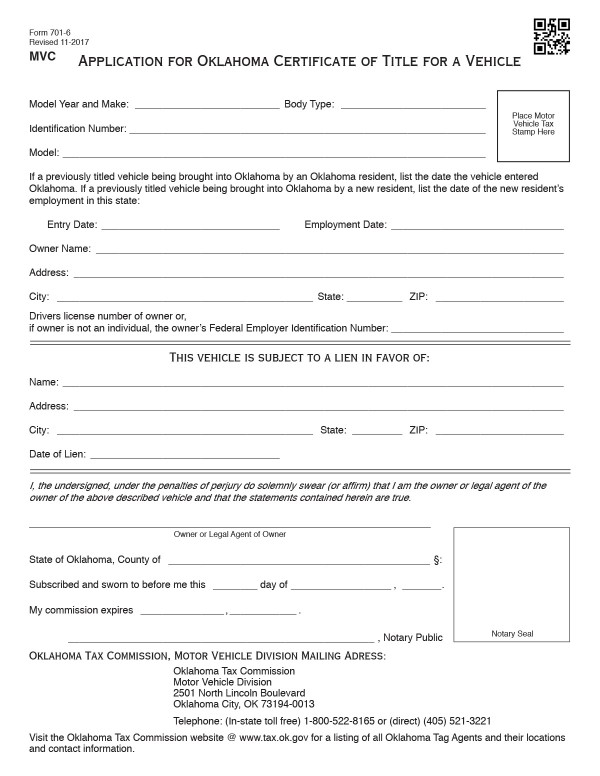

Oklahomans currently pay a 325 percent excise tax on motor vehicles but have been exempt from having to pay the 45 percent state sales tax which applies to most purchases. The actual excise tax value is based on the Blue Book value as established by the Vehicle Identification Number VIN. Tag Tax Title Fees Unconventional Vehicles Boats Outboard Motors Rules Policies IRP IFTA 100 percent Disabled Veterans Sales Tax Exemption Motor Vehicle Exemption Ad Valorem Exemption E-File Free File Businesses Tax Types.

This means that depending on your location within Oklahoma the total tax you pay can be significantly higher than the 45 state sales tax. State Car Tax Rate Tools. State and local taxes that will apply to your purchase.

Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. Find Your States Vehicle Tax Tag Fees When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. Pin On Diecast Car Collection.

You are only allowed the major purchase additional sales tax amount if the sales rate you used for your general state sales tax rate is the same sales tax rate on your major purchase. The cost for the first 1500 dollars is a flat 20 dollar fee. 2 Upon application of a 100 Disabled Veteran or their Surviving Spouse for a sales tax exemption for some por-tion of the purchase price of a vehicle.

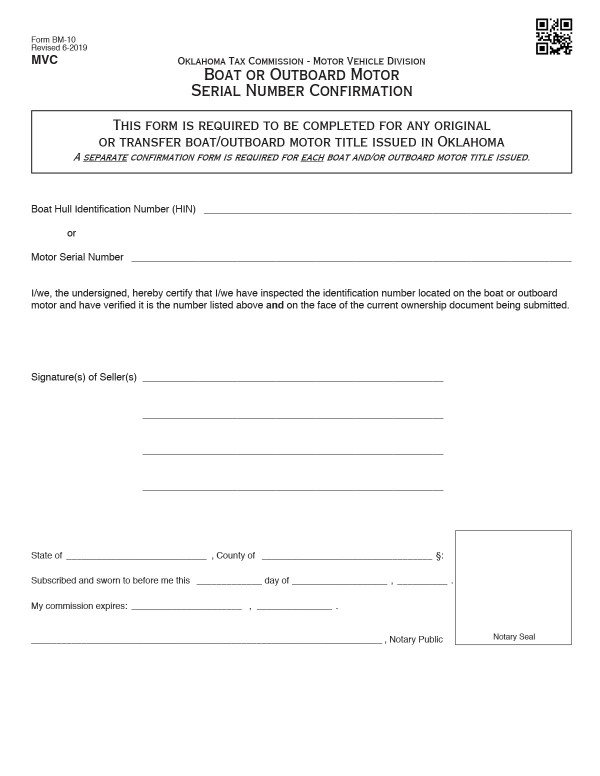

Excise tax on boats and outboard motors is based on the manufacturers original retail selling price of the unit. Typically the tax is determined by the purchase price of the vehicle given that the sale price falls within 20 of the average retail value of the car regardless of condition. Oklahoma Vehicle Bill Of Sale Download The Free Printable Basic Bill Of Sale Blank Form Template Or Waiver In Microsoft W Bill Of Sale Template Bills Oklahoma.

The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price. Whether or not you have a trade-in. 29 county city district total.

Complete the Sales Tax Exemption PermitOTC Sales Tax Letter information below. Oklahoma charges two taxes for the purchase of new motor vehicles. Darcy Jech R-Kingfisher would modify this calculation so the sales tax would be based on the difference between the actual sales price of a vehicle and the value of a trade-in if applicable.

TAX DAY NOW MAY 17th - There are -283 days left until taxes are due. Select the Oklahoma city from the list of popular cities below to see its current sales tax rate. When a vehicle is purchased under current law a sales tax of 125 percent is levied on the full price of the car.

The remaining states have the highest sales tax all 7 or above. The state of Oklahoma does not tax rebates and dealer incentives. Senate Bill 1619 authored by Sen.

The state sales tax rate in Oklahoma is 4500. Oklahomas motor vehicle taxes are a combination of an excise sales tax on the purchase of a vehicle and an annual registration fee in lieu of ad valorem property taxes. This is the largest of Oklahomas selective sales taxes in terms of revenue generated.

2000 on the 1st 150000 of value 325 of the remainder New BoatMotor. For more information about the total cost of purchasing a vehicle please contact the Oklahoma DMV. Some states such as California charge use taxes when you bring in a car from out-of-state even if youve already paid the sales tax on the vehicle.

Tax on Rebates Dealer Incentives. The tax is depending on the purchase price. Oklahoma sales tax car purchase.

Car Sales Tax on Private Sales in Oklahoma. If the purchased price falls within 20 of the Blue Book value then the purchase price will be used. Average DMV fees in Ohio on a new-car purchase add up to 48 1 which includes the title registration and plate fees shown above.

New car sales tax OR used car sales tax. Porsche 918 Spyder Romans International United Kingdom For Sale On Luxurypulse Porsche 918. Of exemption from assessment of Oklahoma vehicle sales tax.

In Oklahoma you must pay an excise tax of 325 of the vehicles purchase price when you register it. Used vehicles are taxed a flat fee of 20 on the first 1500 of the purchase price and the standard. 325 of the purchase price or taxable value if different Used Vehicle.

2000 on the 1st 150000 of value 325 of the remainder. Until 2017 motor vehicles were fully exempt from the sales tax but under HB 2433 the exemption was partially lifted and motor vehicles became subject to a 125 percent sales tax. Vehicle inspections and maintenance.

Its important to note that for used cars the first 1500 has a flat 20 tax and the remainder is then taxed at 325. You will have to pay the Motor Vehicle Excise Tax of 325 for private sales. The state in which you live.

Oklahoma Tax Commission vehicle registration and license plate fees. The county the vehicle is registered in. Please refer to page 2 of this form for important information.

125 sales tax and 325 excise tax for a total 45 tax rate. If the purchase price is. With local taxes the total sales tax rate is between 4500 and 11500.

Motor Vehicle Excise Tax Purchase Types New Vehicle. 325 of the manufacturers original retail selling price Used BoatMotor. 325 of the purchase price or taxable value if different Used Vehicle.

Saturday March 12 2022. States with High Sales Tax. Together these two motor vehicle taxes produced 728 million in 2016 5 percent of all tax revenue in the state.

325 of taxable value which decreases by 35 annually New Manufactured. Oklahoma OK Sales Tax Rates by City. As of July 1 2017 Oklahoma charges a 125 percent sales tax on vehicle purchases in addition to motor vehicle taxes.

Oklahoma has recent rate changes Thu Jul 01 2021.

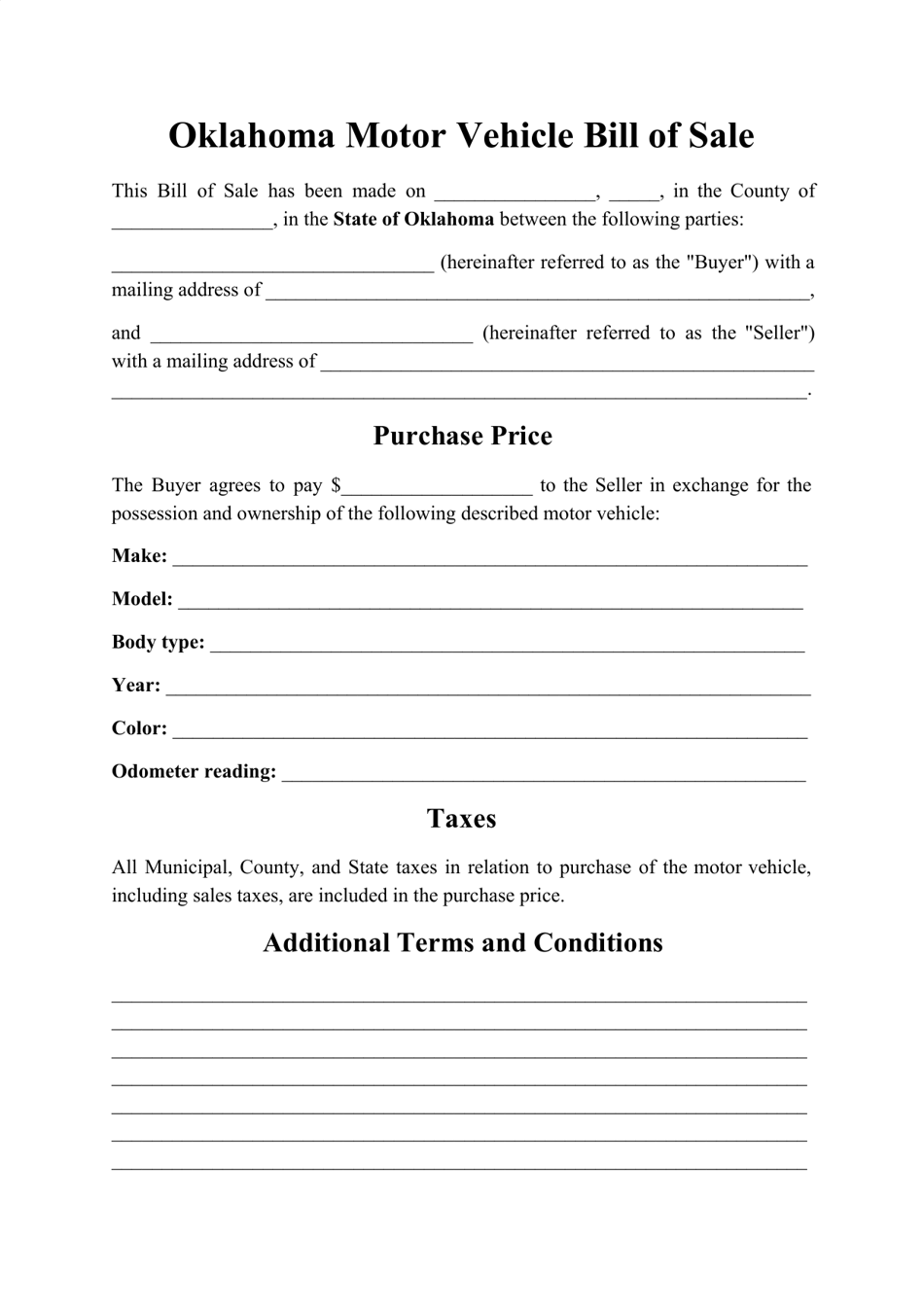

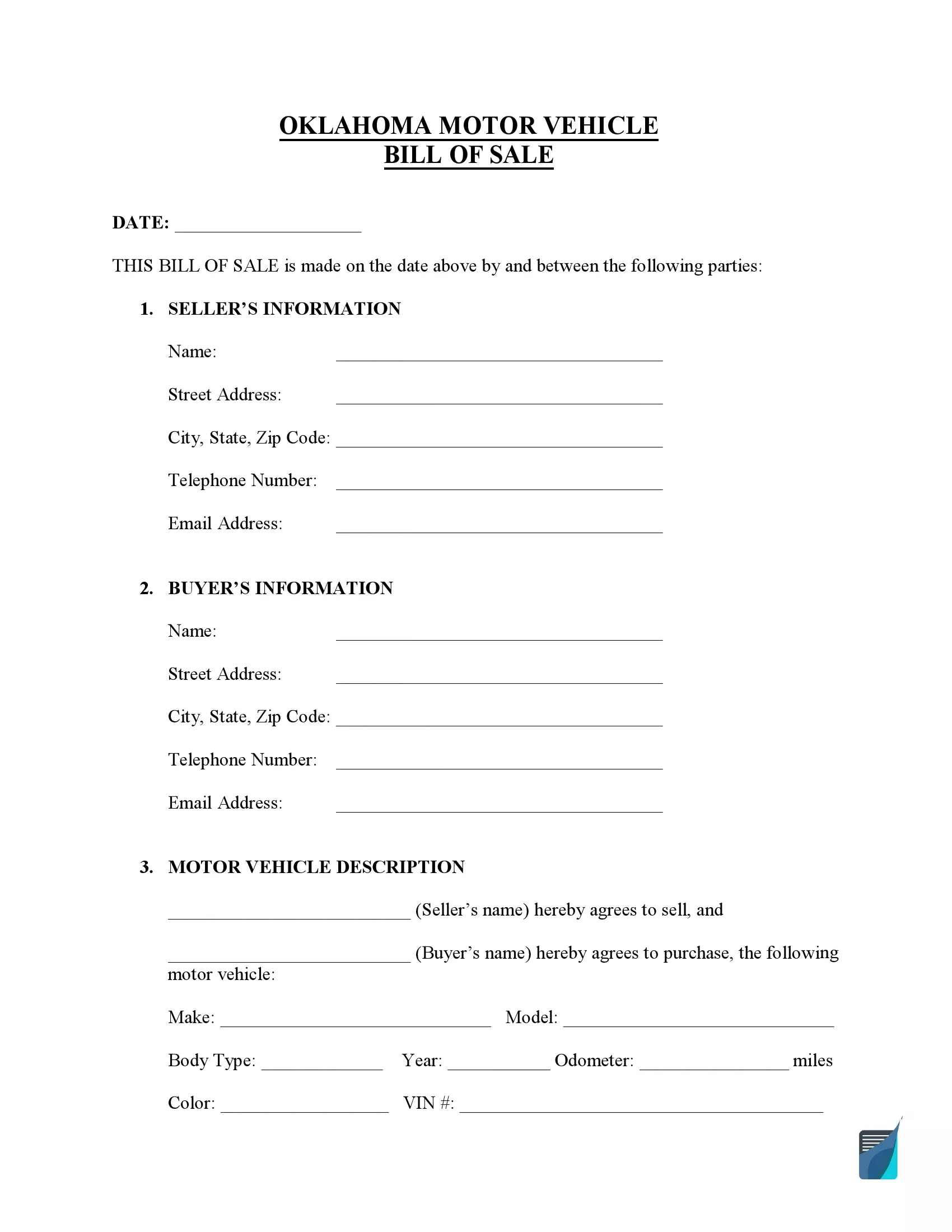

Free Oklahoma Dps Motor Vehicle Bill Of Sale Form Pdf Word Doc

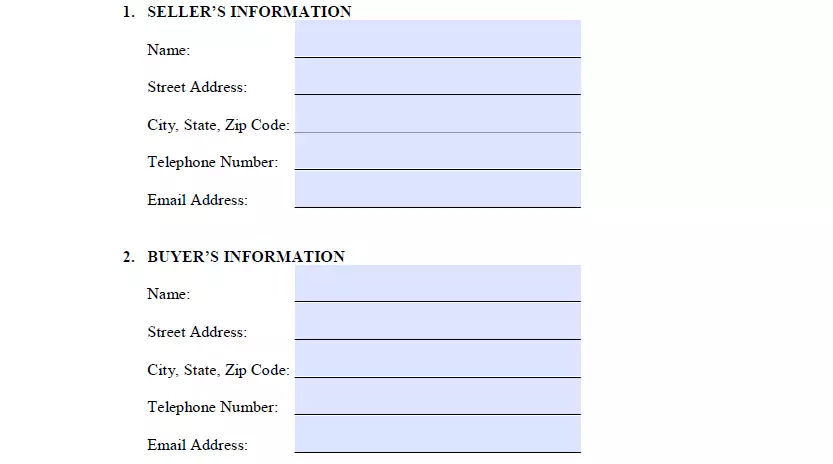

Bills Of Sale In Oklahoma The Templates Facts You Need

Oklahoma Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller

![]()

Free Oklahoma Motor Vehicle Bill Of Sale Form Pdf Word

Bills Of Sale In Oklahoma The Templates Facts You Need

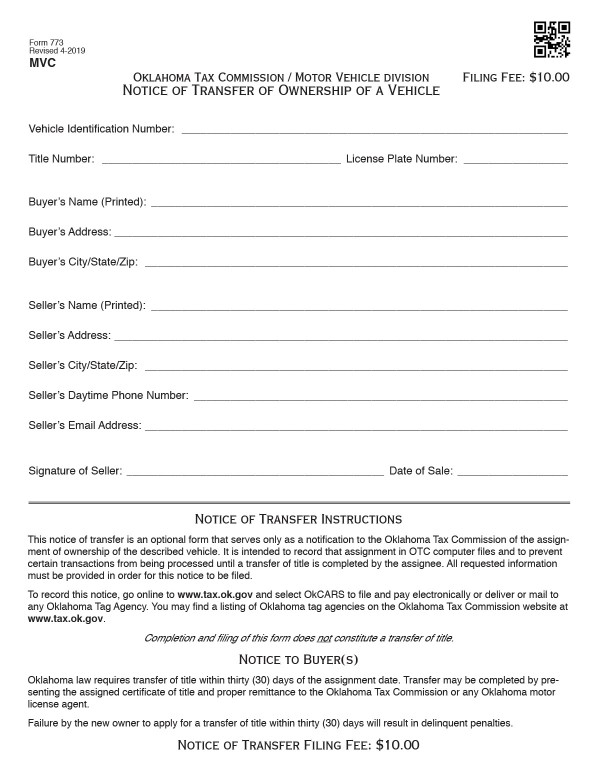

Oklahoma Title Transfer How To Sell A Car Quick At Fair Prices

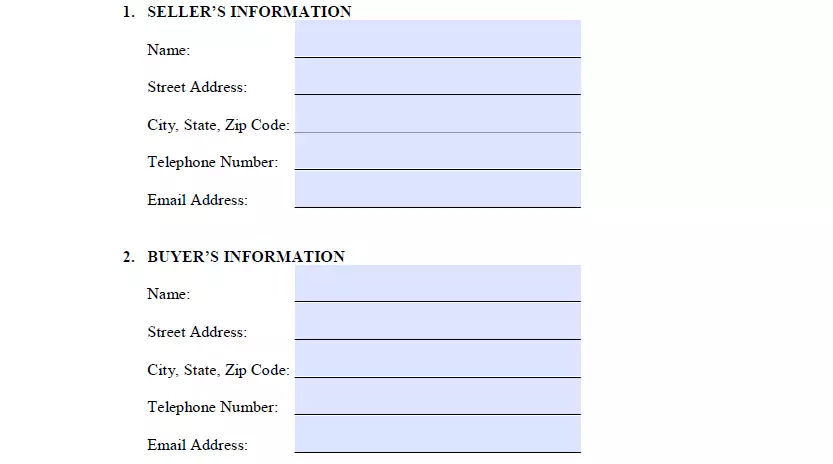

Free Oklahoma Vehicle Bill Of Sale Form Pdf Formspal

Oklahoma Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller

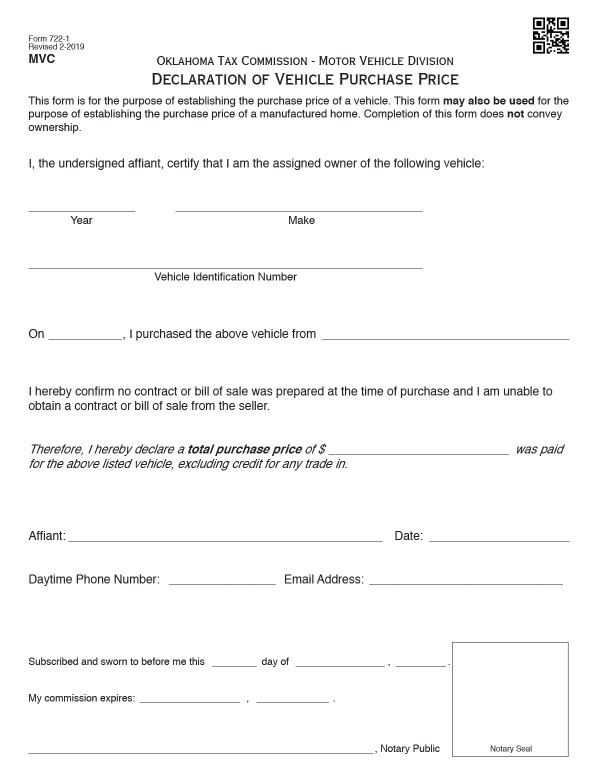

Oklahoma Bill Of Sale Form Dmv Ok Information

Free Oklahoma Motor Vehicle Dmv Bill Of Sale Form Pdf

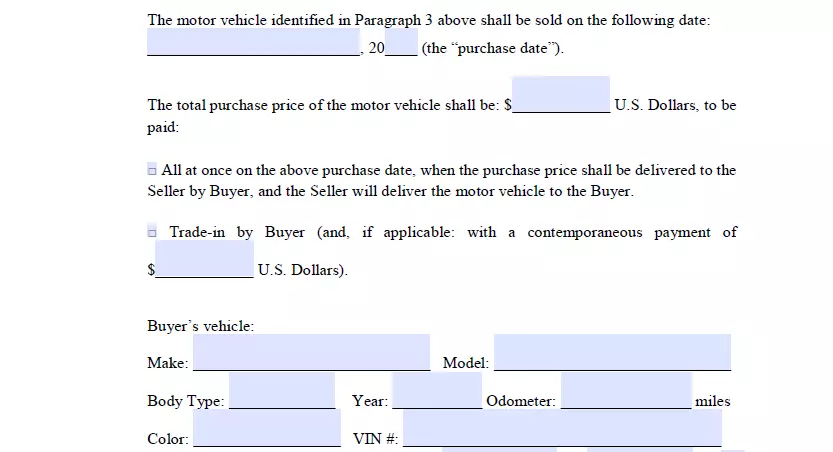

Free Oklahoma Vehicle Bill Of Sale Form Pdf Formspal

Free Oklahoma Vehicle Bill Of Sale Form Pdf Formspal

Oklahoma Vehicle Bill Of Sale Download The Free Printable Basic Bill Of Sale Blank Form Template Or Waiver In Microsoft Bill Of Sale Template Bills Templates

Bills Of Sale In Oklahoma The Templates Facts You Need

Bills Of Sale In Oklahoma The Templates Facts You Need

A Complete Guide On Car Sales Tax By State Shift

What S The Car Sales Tax In Each State Find The Best Car Price

Oklahoma Vehicle Registration And Title Information Vincheck Info